what is the sales tax in wyoming

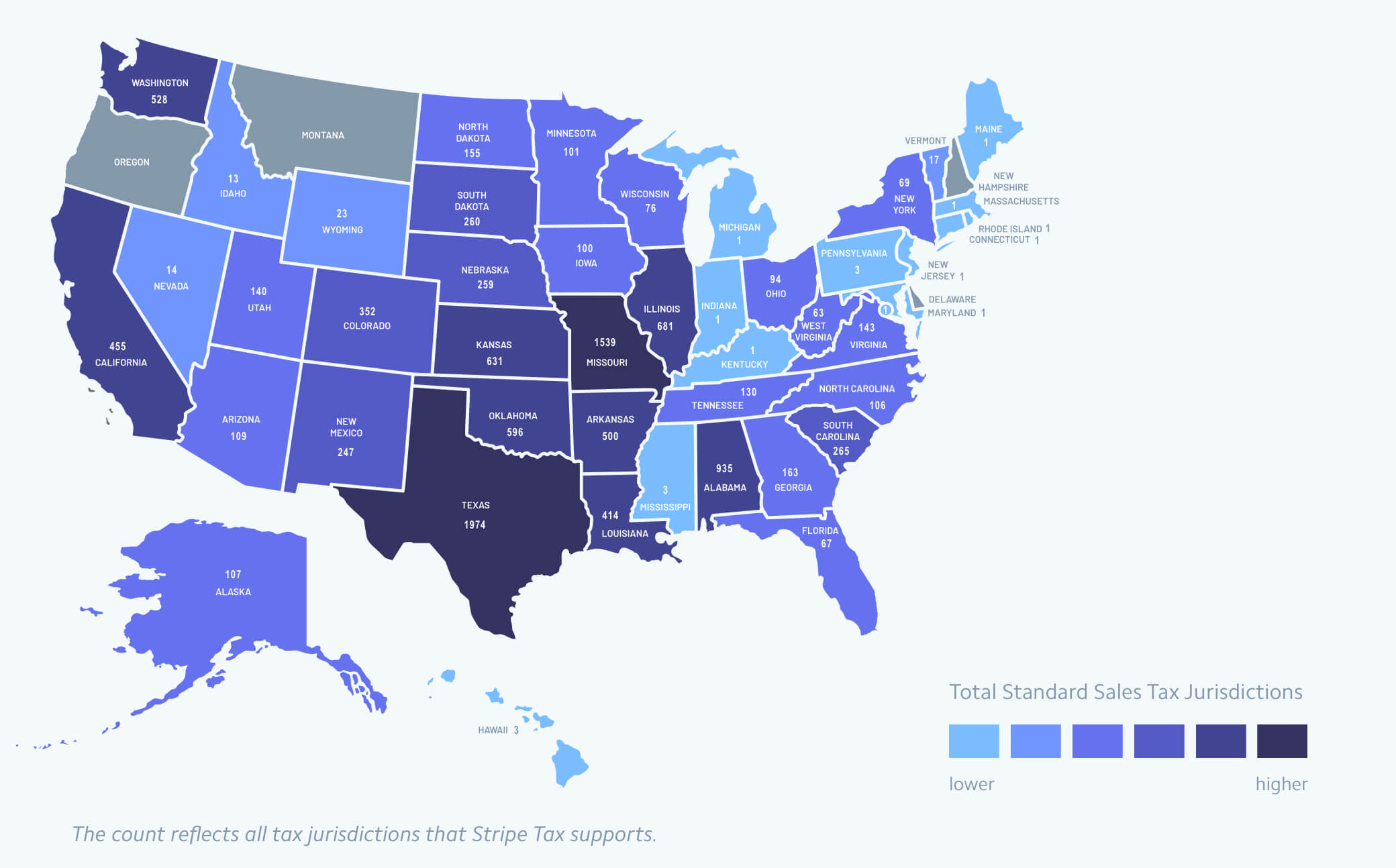

Tax rates can vary based on the location of your business and the location of your customer plus the levels of sales tax that apply in those specific locations. On top of the state sales tax there may be one or more local sales taxes as well as one or.

Introduction To Us Sales Tax And Economic Nexus

Sales Use Tax Rate Charts.

. Wyomings sales tax is 4 percent. Wyoming Sales Tax Guide. The base state sales tax rate in Wyoming is 4.

The Wyoming WY state sales tax rate is currently 4. State wide sales tax is 4. We strongly recommend using a sales tax calculator to determine the exact sales tax amount for.

Wyoming Use Tax and You. The Excise Division is comprised of two functional sections. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6.

However the details of sales tax regulations vary considerably from one state to the next particularly regarding what rate you need to charge your customers and what goods and. Depending on local municipalities the total tax rate can be as high as 6. Find your Wyoming combined state and.

WY Combined State Local Sales Tax Rate avg 5392. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. Maximum Possible Sales Tax.

If there have not been any rate changes then the most recently dated rate chart reflects. The state-wide sales tax in. Heres an example of what this scenario looks like.

This is the total of state county and city sales tax rates. Lowest sales tax 4 Highest sales. Cities counties and other municipalities may also have additional.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Groceries and prescription drugs are exempt from the Wyoming sales tax. Mary owns and manages a bookstore in Cheyenne Wyoming.

In addition Local and optional taxes can be assessed. For example lets say that you want to purchase a new car for 30000 you would use. WY State Sales Tax Rate.

You can calculate the sales tax in Wyoming by multiplying the final purchase price by 04. How much is sales tax on a car in. The Wyoming sales tax rate is currently.

The minimum combined 2022 sales tax rate for Casper Wyoming is. Since books are taxable in the state of Wyoming Mary. 181 rows 2022 List of Wyoming Local Sales Tax Rates.

Average Local State Sales Tax. 31 rows Wyoming WY Sales Tax Rates by City. Tax rate charts are only updated as changes in rates occur.

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1436 for a total of. The state also has several special local and excise taxes. The state sales tax rate in.

How To File And Pay Sales Tax In Wyoming Taxvalet

How To File And Pay Sales Tax In Wyoming Taxvalet

How To File And Pay Sales Tax In Wyoming Taxvalet

Wyoming Alaska And S Dakota Top Tax Friendly Business State List

State Government Tax Collections General Sales And Gross Receipts Taxes In Wyoming 2022 Data 2023 Forecast 1942 2021 Historical

Wyoming Sales Tax Rate Table Ww Woosalestax Com

Wyoming Sales Tax Rate Changes October 2018

Wyoming Sales Use And Lodging Tax Revenue Report Campbell County Chamber Of Commerce

Sales Tax Forms By State Four Seasons Wholesale Tanning Lotion

Wyoming Changes Sales Tax Rules For Remote Sellers

Wyoming County Officials Express Support For 1 Sales Tax Mylocalradio Com

Sales Tax By State Is Saas Taxable Taxjar

What Are Estimated Taxes And Do I Have To Pay Them Wyoming Small Business Development Center Network

Bill Of Sale Form Wyoming Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller

/5_states_without_sales_tax-5bfc38cbc9e77c00519e5498.jpg)

Which States Have The Lowest Sales Tax

Wyoming Sales Tax Tax Rate Guides Sales Tax Usa

New Wyoming Online Sales Tax Rules

Senate Approves Giving Cities Option For Extra 7th Penny Sales Tax Local Jhnewsandguide Com

Wyoming Tax Benefits Jackson Hole Real Estate Legacy Group Jackson Hole